How It Works

We make credit repair simple by guiding you through every step from analysis to results so you can take control of your financial future with clarity and confidence.

At DB Credit Repair, we believe everyone deserves a second chance at great credit. Whether you’re trying to buy a home, finance a car, start a business, or just enjoy financial freedom — it all starts with your credit score. Our proven step-by-step process helps remove inaccurate, outdated, or unverifiable information while educating and empowering you to build strong financial habits that last a lifetime.

How We Work to Improve Your Credit

Full Details

At DB Credit Repair, we use a personalized, results-driven approach. Instead of placing every client into the same plan, we first review your credit report, identify the exact issues affecting your score, and then recommend the right solution for your situation.

Here’s how it works:

Step 1

Credit Report Review & Assessment

1: Once you get started, you’ll be guided to set up credit monitoring with our trusted partner. This allows us to securely access your 3-bureau credit reports.

Our team carefully reviews your report to identify:

Inaccurate or unverifiable accounts

Collections, charge-offs, and late payments

Outdated negative items

High utilization and balance issues

Any violations under the Fair Credit Reporting Act (FCRA)

This review helps us understand the complexity and urgency of your credit file.

2: Custom Quote Based on Your Credit Issues

You’re Quoted Based on What You Actually Need

After reviewing your credit report,

we provide a personalized quote based on:

Number of negative items

Type of accounts being disputed

Estimated dispute cycles required

Level of support needed to reach your goals

This ensures you’re not overpaying or under-serviced.

Step 2

Select Your Recommended Plan & Make Payment

1: Choose the Plan That Fits Your Credit Situation

Once you receive your quote, recommended quote for your credit issues you’ll complete payment through our secure checkout system.

After payment:

Your membership is activated immediately

You’ll receive your service agreement by email

2: Sign the Service Agreement

After payment, you’ll receive an email with your service agreement. Please check your inbox and review it carefully. Once signed, the system will automatically move you to the next step in about 10–15 seconds.

3: Credit Monitoring Setup

Activate your credit monitoring account through our trusted partner. This gives us access to your 3-bureau credit reports so we can begin the dispute process immediately.

Step 3

Upload Documents

Verification Required to Begin Disputes

After dropping the credit monitoring details, you’ll get access to your secure Client Portal to upload required documents for identity verification.

Required Documents:

Social Security Verification (Choose one):

W-2 Form

Pay Stub with full SSN visible

SSA-1099 or SSN

Benefit Statement

Photo ID (Choose one):

State ID

Passport or Passport Card

Military ID

Permanent Resident Card

Employment

Authorization Card

Tribal ID Card

Proof of Address (Dated within last 3 months):

Utility Bill

Bank or Credit Card Statement

Lease or Mortgage Statement

Insurance Policy

Recent Pay Stub

Government-Issued Letter

Step 3

We Go to Work

Legal Dispute Process Begins

Once verified, we begin disputing inaccurate, outdated, or unverifiable items by:

Sending targeted dispute letters to credit bureaus and creditors

Using FCRA-compliant strategies

Tracking all responses and progress on your behalf

This review helps us understand the complexity and urgency of your credit file.

Step 4

Ongoing Support & Credit Education

More Than Just Disputes

You’ll receive:

Removed or corrected account notifications

Credit education and coaching

Guidance on building positive credit

Alerts if new negative items appear

You’ll also have 24/7 access to your Client Portal.

Step 5

Results & Progress Tracking

Every 35–40 Days

We pull updated credit reports to track:

Accounts removed or updated

Balance changes

Score improvements (when applicable)

You’ll receive detailed email updates and next-step guidance with every dispute cycle.

Get Started now to begin your credit repair journey

we’ll take care of the rest.

Why Credit Matters

Credit can affect everything from home loans, auto loans, rental agreements, insurance, social status, and even employment. Bad credit means higher rates on just about everything related to borrowing money. Making a plan to try to improve you credit will help save you money.

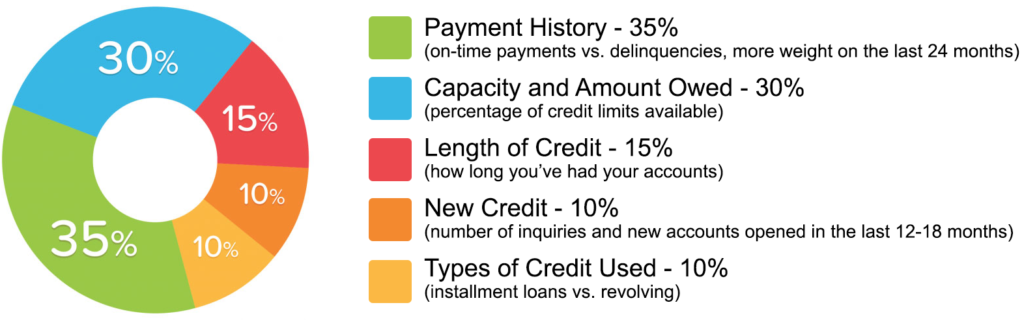

Credit Facts

Payment History

Amounts Owed

Length of Credit History

Taking on More Debt

Types of Credit in Use

What affects your Credit Score?

We will help you to dispute negative items in your Credit history.

Late payments

Collections

Charge-offs

Medical bills

Utility collections

Personal loan

Student loan

Repossessions

Foreclosures

Evictions

Judgments

Bankruptcies

Closed accounts

Incorrect information and More

Money-Back Guarantee:

If no negative items (excluding personal information such as names, addresses, or employment history) are removed from your credit report within the 6-month program, you may qualify for a full refund.

To remain eligible:

● You must maintain an active Smart Credit membership throughout the program.

● If we are unable to access your credit report for 14 consecutive days, services will be terminated without a refund.

Improve Your Credit Within 30-90 Days

Ready to Rebuild Your Credit Today?

Legal Disclaimer

We provide credit review and dispute assistance services in accordance with applicable federal and consumer protection laws. Our role is limited to disputing information that may be inaccurate, incomplete, outdated, or unverifiable based on the information provided by the client.

We do not guarantee the removal of any specific item, credit score increase, or particular outcome. Items that are verified as accurate by credit bureaus or data furnishers may remain on the credit report.

Services include up to six (6) months of dispute support. Results vary based on individual credit profiles and third-party response timelines.

Options:

Get in Touch

Email: [email protected]

Customer Support: 📞Call Now

Whatsapp Us: https://wa.me

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours : Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED

More Links